|

As employers’ awareness and understanding of the Employer Shared Responsibility (“Pay-or-Play”) provisions has increased, many employers have started asking how the government will know whether employer-provided coverage was “affordable” and provided “minimum value” and to which employees the coverage was offered. These are important issues, since the Affordable Care Act (ACA) imposes a penalty on an employer only if a full-time employee received a subsidy for purchasing health insurance in an exchange, and an employee is not eligible for a subsidy if employer-provided health coverage was available and met “affordability” and minimum value requirements.

To answer these questions, of January 1, 2014, new federal tax reporting requirements apply under Code sections 6055 and 6056 (added by ACA sections 1502(a) and 1514(a), respectively). Employers and other reporting entities will need to have  systems in place by the beginning of 2014 to start collecting the necessary information, because the first information returns will be filed in 2015 (reporting on coverage provided in 2014). It is anticipated that proposed regulations (expected soon) will allow employers with insured health plans to contract with issuers to have the issuers include in their annual filings some or all of the information employers are also required to file. However, employers will still have to be involved in the process of helping Health and Human Services (HHS) and Exchanges determine which employees are eligible for subsidies (premium tax credits and cost-sharing reductions). (In recently-proposed regulations, HHS proposed methods by which employers might voluntarily be able to provide this information when an employee applies to an Exchange for health insurance coverage. (For additional information, go to www.HealthReformUpdates.com) systems in place by the beginning of 2014 to start collecting the necessary information, because the first information returns will be filed in 2015 (reporting on coverage provided in 2014). It is anticipated that proposed regulations (expected soon) will allow employers with insured health plans to contract with issuers to have the issuers include in their annual filings some or all of the information employers are also required to file. However, employers will still have to be involved in the process of helping Health and Human Services (HHS) and Exchanges determine which employees are eligible for subsidies (premium tax credits and cost-sharing reductions). (In recently-proposed regulations, HHS proposed methods by which employers might voluntarily be able to provide this information when an employee applies to an Exchange for health insurance coverage. (For additional information, go to www.HealthReformUpdates.com)

Brief Summary of the New Reporting Requirements

Large employers (those with at least 50 full-time employees or “full-time equivalents”) will be required to file annual reports with the IRS on the terms and conditions of their health care coverage for full-time employees during the prior year. The IRS will use this information to verify employer-sponsored coverage and to administer the employer shared responsibility provisions under Code section 4980H(a) and (b). Employers also must furnish written statements by January 31 to each full-time employee whose information was reported to the IRS. (Code section 6056 and IRS Notice 2012-33)

Additionally, entities that provide “minimum essential coverage” (insurance issuers, self-funded plan sponsors and government agencies that administer government-sponsored health insurance programs) will be required to file annual reports that provide information on each individual for whom they provide the coverage. It is anticipated that regulations will make insurance issuers responsible for the reporting for insured group health plans. (Code section 6055 and IRS Notice 2012-32)

In Notices 2012-32 and 2012-33, the IRS requested comments on issues arising under these two reporting requirements, including possible ways the IRS can coordinate and minimize duplication between the information required to be reported and furnished by employers and other entities (such health insurance issuers and government providers of health coverage).

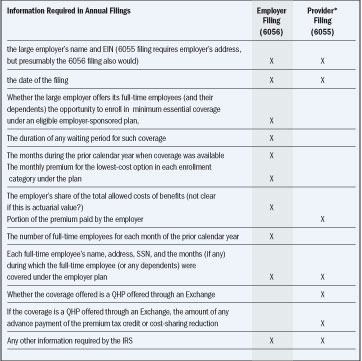

Comparison of Filing Requirements Under Code Sections 6055 and 6056

As indicated below, much of the filing information required by sections 6055 and 6056 is duplicative. The IRS will provide, to the  maximum extent feasible, that any large employer return required under 6056 may be filed as part of a return or statement under 6055 or 6051 (relating to employer reporting on Form W-2). A large employer that offers insured health coverage may contract with the issuer to have the issuer provide the information required under 6056 as part of the return and statement provided by the issuer under 6055. maximum extent feasible, that any large employer return required under 6056 may be filed as part of a return or statement under 6055 or 6051 (relating to employer reporting on Form W-2). A large employer that offers insured health coverage may contract with the issuer to have the issuer provide the information required under 6056 as part of the return and statement provided by the issuer under 6055.

* Provider is an entity that provides “minimum essential coverage” (MEC). This includes insurance companies (issuers), self-insured plan sponsors and government entities that administer government-sponsored health insurance programs.

Reporting Requirements on Large Employers

Large employers that are subject to the Employer Shared Responsibility provisions must file an annual report with the IRS (in January 2015) on the terms and conditions of their health care coverage for full-time employees during the prior year. The IRS will use this information to verify employer-sponsored coverage and to administer the employer shared responsibility provisions under 4980H(a) and (b). Employers also must furnish a written statement by January 31 to each full-time employee whose information was reported to the IRS. As noted earlier, regulations expected soon may relieve large employers with insured plans of some or all of these reporting requirements, if the information is reported annually by the health insurance issuer. Self-funded plan reporting will be done either by the plan sponsor or possibly by the third-party administrator.

As summarized in the matrix above, the annual return (required by Code section 6056) that large employers will file with the IRS must:

Additionally, the entity that files the information return with the IRS (reporting minimum essential coverage) must furnish a written statement to each individual listed on the return that shows the information that was reported to the IRS for that individual.

Source: The Leavitt Group/LGAA, Inc.

|