By: David Shulman

Today’s office market headlines are dominated by places such as San Francisco, where a resurgent technology sector has encouraged developers to plan the first new office towers in years.

But the overall picture is much more discouraging. More than three years after the Great Recession officially ended and with almost no new construction, the national office vacancy rate remains at an elevated 17.1%. If this were a more normal recovery, the vacancy rate would be plummeting by now. However, the recovery has been decidedly weak, and feeble demand is exacerbated by the restructuring of the office-intensive industries that drive demand, and by more efficient utilization of office  space. As a result, vacancy rates are likely to stay high longer than what most real estate professionals now expect, and we might be facing a lengthy period of excess capacity similar to the supply shock years Even before the Great Recession, the office business was sick.” space. As a result, vacancy rates are likely to stay high longer than what most real estate professionals now expect, and we might be facing a lengthy period of excess capacity similar to the supply shock years Even before the Great Recession, the office business was sick.”

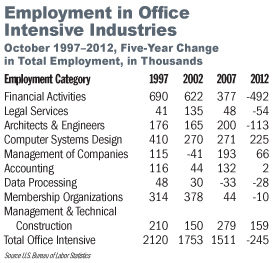

Simply put, many of the office-intensive industries have stopped growing, and in aggregate our proxy measure for office employment declined by 245,000 jobs over the last five years, compared to a gain of 1.5 million over the prior five year period.

Perhaps more importantly, financial activities and legal services employment, the bedrock of office demand for Class A space, are employing about the same number of workers as they did a decade ago! What is worse, the outlook for future employment growth in these two industries is hardly encouraging.

Weighed down by increased regulation and pressures to consolidate, the financial services industry appears to have lost the dynamism it had for the 25 years leading up to the crash of 2008. Similarly, legal services is facing reduced demand from the financial industry and the downward adjustment in billing rates caused by a hardened attitude of corporate clients toward legal expenses.

To be sure, other sectors of office employment expanded over the past five years; most notably computer systems design (software) and consulting. Thus it is no accident that those markets associated with computer software and management and technical consulting have recovered rapidly from the recession. As a result, occupancies and rents are rising in San Francisco, Silicon Valley and Seattle. Enough so that significant new construction is now contemplated for those markets.

Make no mistake: Those technology-oriented markets, along with a few of the energy-oriented hubs, are the exception. Most markets are suffering from minimal absorption and stubbornly high vacancy rates. Even with all of the employment gains and inflation over the past 25 years or so, nominal rents haven’t gone anywhere. Yes, Midtown Manhattan, San Francisco, West Los Angeles and Washington D.C. are exceptions, but for the vast majority of local markets nominal office rents today are equal to or lower than the peaks achieved in the 1980s. And before the denizens of the cities cited, as exceptions get too smug, it is important to note that rents are still below the peak levels attained in the 2000 dot.com bubble. In real terms, the rent collapse has been devastating, but it has been masked by a decline in capitalization rates. Even before the Great Recession, the office business was sick.

Going forward, the resumption of job growth will certainly improve market conditions, but that will be offset, in part, by a decline in the space used per worker. According to CoreNet Global, a consortium of office users and workplace professionals, the planned space per worker will decline from 225 square feet in 2010 to 151 square feet in 2017. Specific users identified in this process include Microsoft, Credit Suisse and Unilever. Because there is a lag between planned space per worker and actual space per worker, the downsizing process will take longer.

The reduction in space per worker is largely being driven by technology and cost. Of course, cost has always been a factor, but  with margins being squeezed in finance and law, its effect seems to be increasing. In some respects technology is a game changer. It works to reduce space demands by eliminating the need for file cabinets and credenzas as hard drives substitute for paper and local servers are replaced by remote “cloud” servers. It also enables working from distant locations and from home. Furthermore, the open floor plan environments used by most technology companies have been emulated in other industries. with margins being squeezed in finance and law, its effect seems to be increasing. In some respects technology is a game changer. It works to reduce space demands by eliminating the need for file cabinets and credenzas as hard drives substitute for paper and local servers are replaced by remote “cloud” servers. It also enables working from distant locations and from home. Furthermore, the open floor plan environments used by most technology companies have been emulated in other industries.

As a result, short of a boom, I am hard pressed to come up with a scenario where office vacancy rates significantly decline over the next few years. To be sure, the vacancy rate will decline, but it likely will be more gradual than what most market participants now expect.

David Shulman, Senior Economist, UCLA Ziman Center for Real Estate and UCLA Anderson Forecast. Email: david.shulman@anderson.ucla.edu.

|